U.S. Customs Import Requirements

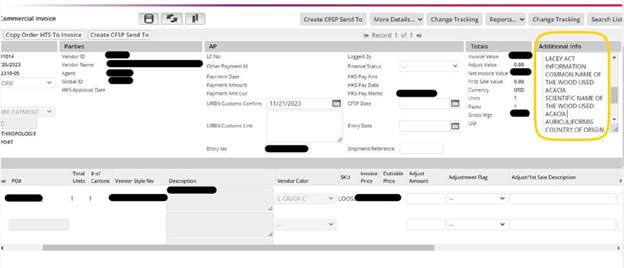

Lacey Act:

Effective October 14th, 2024 all products containing any amount of wood, cork, or other vegetable material will require Lacey Act information to clear U.S. customs.

Lacey Act information must be entered in the additional information box on the invoice screen in Tradestone by the URBN Vendor. If your sample or non-merch shipment requires Lacey Act information then it should be included on the non-Tradestone invoice.

Separate Lacey Act forms are not accepted.

For additional information on Lacey Act requirements, please visit: https://www.aphis.usda.gov/plant-imports/lacey-act

Items that require Lacey Act include(but are not limited to): Wood, bamboo, and rattan furniture. Picture frames. Wood cutting boards, cheeseboards, cake stands, spoons/other cutlery, bowls and plates. Kitchen and garden utensils, brooms, dusters, and tools with wood handles. Jewelry boxes and other storage boxes. Wood handbags. Plaited vegetable material baskets and handbags. Room diffuser scent sticks. Cork products. Sunglasses with wood frames. Wood clocks and watches. Shoes with wood or cork platforms. LED lighting made of wood. Pencils, Wood combs, hair slides, and hair pins. Dummies and mannequins, and all other items made of any amount of wood, cork, or other vegetable materials.

The below information must be entered in Tradestone:

Please include Style Number & the following:

- Common name of wood used:

- Scientific name of the wood used (both genus and species names must be included):

- Country of origin of the wood:

- Total quantity of wood (in kilograms, meters, meters squared, or meters cubed):

For questions regarding whether your style falls under the Lacey Act, please contact kbotto@urbn.com.

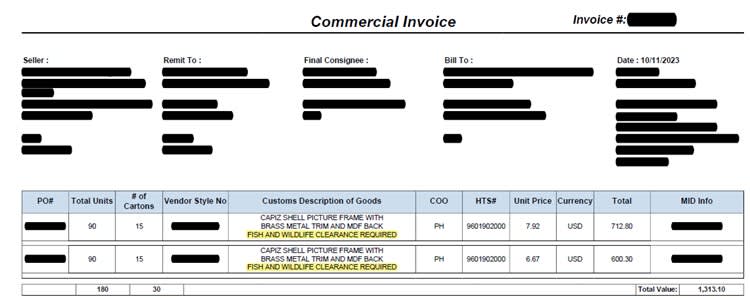

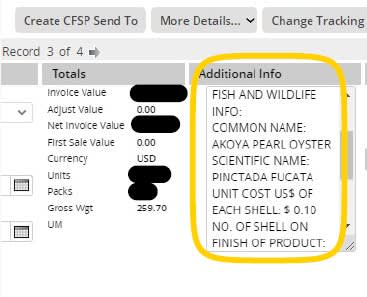

Fish and Wildlife:

Products containing genuine shell, feathers, or pearls require fish and wildlife information to clear U.S. Customs.

The below information must be entered in the additional information box on the invoice screen in Tradestone by the URBN Vendor.

*If your sample or non-merch shipment requires fish and wildlife information then it should be included on the non-Tradestone invoice.

Fish and Wildlife Information

Please include Style Number & the following:

- Common name of the shell:

- Scientific name (must include both genus and species names):

- Number of fish and wildlife items on each item:

- Total number of each type of fish and wildlife in shipment:

- Unit price of each type in $USD:

- Country of origin (country that the shell is native to, not where the garment is made):

- Source of the item (taken from the wild or born in captivity):

If you are shipping genuine shell product made in the Philippines, the original Bureau of Fisheries and Aquatic Resources export commodity clearance document must be mailed to URBN’s customs broker.

For questions relating to fish and wildlife, please contact kbotto@urbn.com.

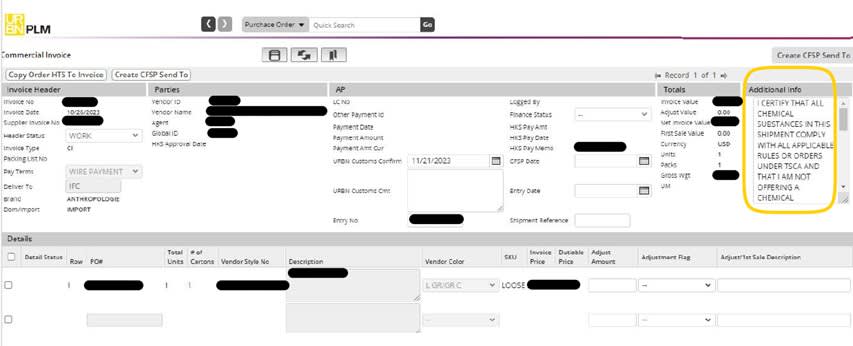

TSCA Title IV:

Products containing any amount of MDF, plywood, or composite wood must include the TSCA statement on the commercial invoice. It is the responsibility of the URBN vendor to enter the TSCA statement in the additional information box on the invoice screen in Tradestone for regular POs.

If your sample or non-merch shipment requires a TSCA statement then it should be included on the non-Tradestone invoice:

“I certify that all chemical substances in this shipment comply with all applicable rules or orders under TSCA and that I am not offering a chemical substance for entry in violation of TSCA or any applicable rule or order thereunder.”

- Common items containing these materials include furniture, picture frames, and mirrors.

Sunglasses:

Sunglasses require additional information to clear U.S. Customs and the U.S. Food and Drug Administration (FDA)

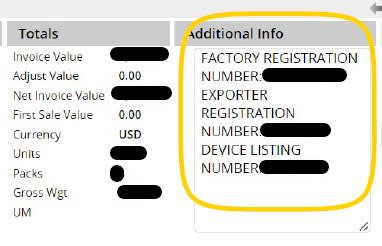

The factory FDA registration number, vendor FDA registration number, and device listing number need to be entered in the additional information box on the invoice screen in Tradestone by the URBN Vendor.

The URBN Vendor will also need to provide the drop ball test certificate for each style to the freight forwarder. The manufacturer on the drop ball test must match the actual manufacturer listed on the Tradestone invoice.

CITES:

The Convention on International Trade in Endangered Species of Wild Fauna and Flora (CITES) is an international treaty to prevent species from becoming endangered or extinct because of international trade. International trade of species listed by CITES is illegal unless authorized by permit. Items prohibited by CITES include, but are not limited to, parts and derivatives made from sheesham wood, rosewood, python skin, ivory, tortoise shell, reptile, fur skins, and coral. Permits to import/export items listed on CITES endangered list into/from United States are issued by the Office of Management Authority of the U.S. Fish and Wildlife Service.

To determine if you need a permit, check the CITES database. If your product has a component that is identified on this list, you must apply for a foreign CITES export or re-export document issued by the appropriate CITES office in the country from which the product is exported from. The validated foreign CITES export document must be included in the shipping documents given to the freight forwarder/courier service that the shipment is booked with. The original CITES certificate must be mailed to URBN’s customs broker.

For questions relating to CITES, please contact Kelly kbotto@urbn.com.

Carton Counts:

Carton count on the Tradestone invoice must match the amount handed over to the freight forwarder.

It is the responsibility of the URBN vendor to ensure that the total carton count on the Tradestone invoice and packing list match the carton count on the AWB or FCR. If not, the URBN Vendor must notify the URBN import compliance team.

Providing incorrect documentation to the freight forwarder is a chargeback offense.

Tradestone Invoices:

Tradestone documentation is required for all regular import POs and must be handed over to the freight forwarder. Failure to do so will result in a chargeback

The only exceptions to this rule are for non-merch and sample shipments where non-tradestone invoices are accepted.

U.S. Import Shipping Requirements:

For questions relating to how to ship your U.S. Import PO, please refer to the International Routing Guide

Chargebacks will be issued for failure to include any of the above mentioned information required for U.S. Imports.

For questions pertaining to anything included in this section, you can contact Kelly (KBotto@urbn.com).